S&P Global Canada Manufacturing PMI report released

By S&P Global Market Intelligence

News Canada Manufacturing PMI S&P Global Market IntelligencePMI up to three-month high on back of slower falls in output and new orders

The downturn of Canada’s manufacturing sector was extended into the start of 2024 with concurrent falls seen in output, new orders, and employment. However, rates of decline softened since December, whilst confidence in the future improved. Latest prices data also showed weaker rates of both input and output price inflation despite reports of shipping delays caused by the crisis in the Red Sea.

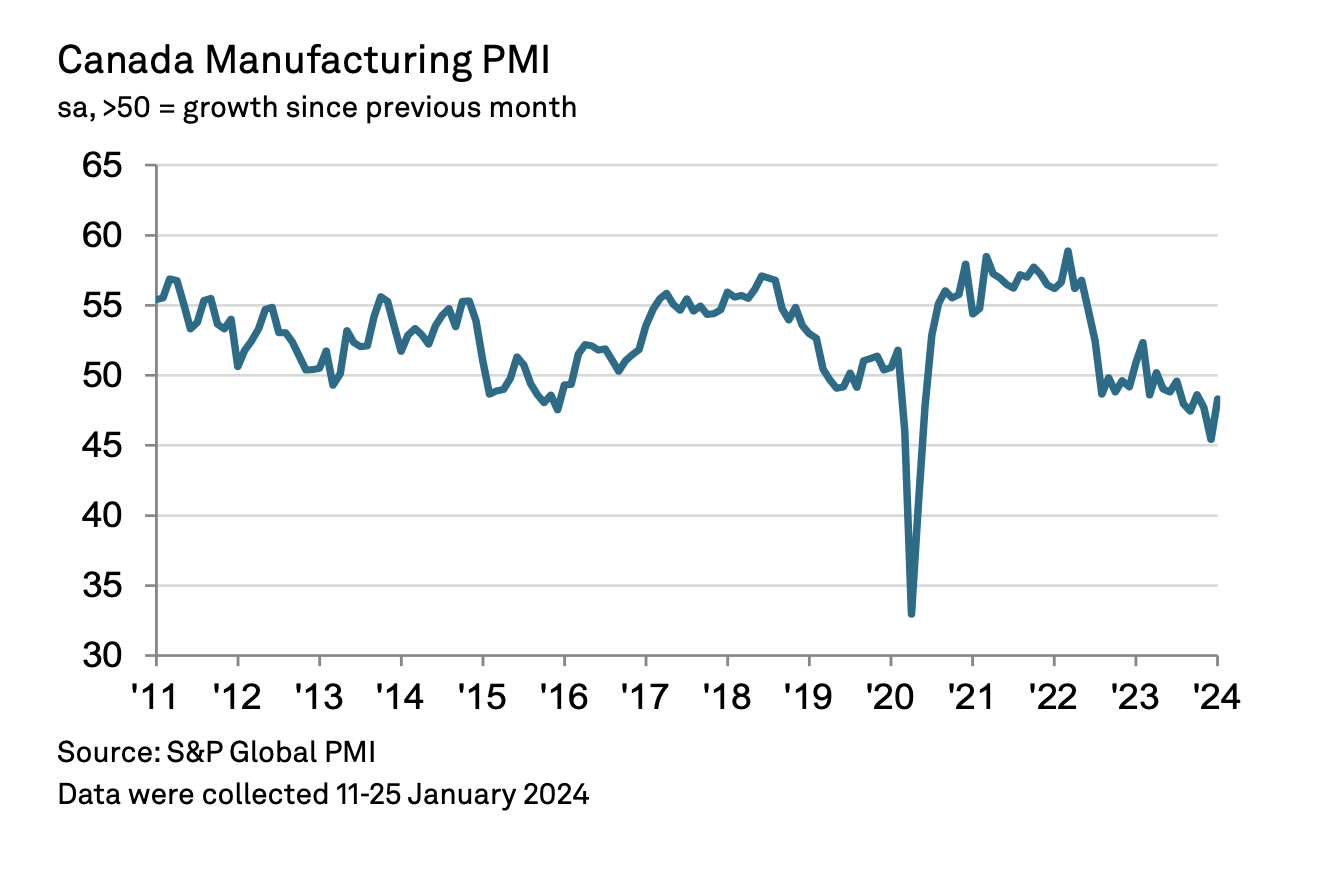

The seasonally adjusted S&P Global Canada Manufacturing Purchasing Managers’ IndexTM (PMI), a composite single-figure indicator of manufacturing performance derived from indicators for new orders, output, employment, suppliers’ delivery times and stocks of purchases, remained below the crucial 50.0 no-change mark during January for a ninth month in a row to signal another deterioration in operating conditions. However, by rising to 48.3, from 45.4 in December, the PMI pointed to the weakest rate of sector contraction since last October.

Production was cut for a sixth month in a row during January, whilst there was another drop in new orders. However, in both cases, rates of decline were slower than at the end of 2023. Panellists nonetheless commented on soft market demand, and an unwillingness amongst clients to commit to new work especially against a backdrop of elevated market prices. Demand from abroad was also lower, with various conflicts from around the world cited as a factor weighing on sales. New export orders declined during January for a fifth month in a row.

On the jobs front, firms continued to cut employment at the start of the year, albeit only marginally. Where employment was reduced, this was linked to lower production requirements and sufficient capacity. Indeed, backlogs of work were reduced for an eighteenth successive month according to the latest data.

A preference for input destocking and lower output also discouraged buying activity in the latest survey period, which fell – albeit to a much lower degree – again in January. Stocks of purchases were also cut, although in line with many other variables covered by the survey, also at a slower rate.

January saw the continued easing of inflationary pressures. Both input prices and output charges rose at slower rates according to the latest data. Where input costs increased, this was linked to higher prices for goods like steel. There were also reports that supply-chain delays had a mild inflationary impact. Global shipping delays linked to challenges in the Red Sea and the Suez Canal reportedly led to a deterioration in vendor times, according to panellists.

Finally, confidence in the future improved in January, hitting its highest level in six months. According to panellists, planned marketing and the release of new products, alongside organic company growth and an improvement in demand should all boost output.

“Canada’s manufacturing sector performance remained subdued at the start of 2024 as weak underlying demand for goods remained apparent. This continued to weigh on production levels and led to further cuts in purchasing activity and another round of job losses, albeit to lesser degrees than seen at the end of last year,” said Paul Smith, economics director at S&P Global Market Intelligence, commenting on the latest survey results. “Despite remaining inside negative territory, the latest data therefore provide hope that the downturn in the sector is bottoming out. Moreover, firms are looking to brighter times in the next 12 months, with output expectations hitting a six-month high. Manufacturers and indeed policymakers will also be encouraged by the latest price indices, which continued their recent disinflationary paths in January.”

Print this page